dependent care fsa rules 2021

A lot of employers had to let people go. A Dependent Care FSA DCFSA is used to pay for childcare or adult dependent care expenses that are necessary to allow you and your spouse if married to work look for work or attend school full-time.

For 2022 the contribution limit is 2750.

. The carryover option expires on December 31 2021. Dependent-care Flexible Spending Accounts FSA let employees use tax-exempt funds to pay for childcare expenses they incur while at work. This relief applies to all health FSAs including HSA-compatible health FSAs and also applies to all dependent care assistance programs.

The employee has 5500 of dc fsa benefits available as of january 1 2022. Child care at a day camp nursery school or by a private sitter. On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden.

Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars. For 2022 the FSA carryover has been raised to 570 Normally a dependent care FSA also known as a Dependent. If you are interested in making a change to your DCFSA election.

Employers can choose whether to adopt the increase. PY2021 Health Care FSA Unlimited Carryover Under Internal Revenue Service guidance employers may allow all unspent funds from the 2021 Health Care Flexible Spending Account HC FSA plan year to be carried over to the 2022 plan year. The State of Michigan has adopted this change.

Arpa increased the dependent care fsa limit for calendar year 2021 to 10500. On February 18th the IRS issued Notice 2021-15 to explain the temporary health flexible spending account FSA and dependent care FSA ie a dependent care assistance program DCAP relief in the Consolidated Appropriations Act CAA and to build upon temporary election change relief for other pre-tax benefits from last years Notice 2020-29 among other. While it is optional we have decided to adopt this change.

4000 from the 2020 plan year into the 2021 plan year and who elects to contribute 3000 to a dependent care FSA for the 2021 plan year will have 7000 ie 3000 election 4000 carryover available to pay dependent care. Earlier in 2020 the IRS updated the rules to increase the maximum health FSA carryover from 500 to 550. ARPA increased the dependent care FSA limit for calendar year 2021 to 10500.

The act also increases the value of the dependent care tax credit for 2021. However due to COVID-19 the age limit was bumped to age 14 in 2021 for any unused 2020 money. However health FSA amounts may be used only for medical care expenses and dependent care assistance program.

Congress decided they shouldnt lose access to their. The 2021 dependent-care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and 5250 for married couples. As we navigate the COVID-19 pandemic together employers have asked for relief under current Section 125 cafeteria plan rules that will permit changes to help employees with.

That includes employees who were laid off during the pandemic. The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money. Although the CAA allowed employees to.

Help employees during the COVID-19 emergency by allowing FSA relief through 2021 plan years. Unemployment was high in the whole nation Dietel says. 129 one-time fee ordered via fax or email.

ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only. Meanwhile the limit on contributions to dependent-care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in March. The new dependent care FSA annual limits for pretax contributions are 10500 up from 5000 for single taxpayers and.

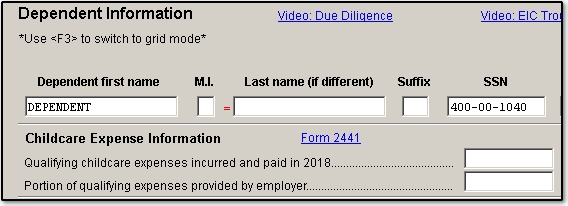

PA Group administers our FSA plan including reimbursements. Remaining in an employees health FSA as of December 31 2021 to the 2022 plan year. Typically the maximum age for a child to qualify for dependent care through an FSA is 13.

Under the regular cafeteria plan rules dependent care FSAs are not permitted to include a carryover feature. This amount is set by statute and not. Placement fees for a dependent care provider such as an au pair.

This amount is set by statute and not. 99 one-time fee ordered online. Dependent care flexible spending account fsa.

As with the standard rules the limit is reduced to half of that amount 5250 for married individuals. Health Care FSA Temporary Plan Revisions. As with the standard rules the limit is reduced to.

However if you did not find a job and have no earned income for the year your dependent care costs are not eligible. The 2022 family coverage HSA contribution limit increases by 100 to 7300. Employees may carry over all or some of their unused health andor dependent care FSA funds from a plan year ending in 2020 or 2021 explained Marcia Wagner founder of The Wagner Law Group.

3 Any unused amounts from your 2020 Child Care Dependent Care FSA will automatically be carried over into 2021 and may be used to pay or reimburse eligible dependent care expenses that are incurred in 2021. Under the changes employees with health or dependent care FSA accounts have until the end of 2021 to spend their funds. Unused health and dependent care FSA funds are forfeited at the end of the plan year known as the.

Dependent Care FSA Increase Guidance. The Consolidated Appropriations Act allows for unused DCFSA money to roll over from 2020 to 2021 plans and from 2021 to 2022 plans. Nursery schools or pre-schools.

February 11 2021 2021-R-0054 Issue Explain federal rules that apply to health and dependent care flexible spending accounts also called arrangements including the use it or lose it rule and summarize any relief from the rules. For married couples filing joint tax. In response to the COVID-19 public health emergency Congress passed a provision in the Consolidated Appropriations Act of 2021 CAA which allowed employers to adopt a 100 carryover or 12-month grace period for their dependent care flexible spending account DC FSA for the 2020 and 2021 plan years.

Dependent Care Flexible Spending Account FSA. Licensed day care centers. ARPA Dependent Care FSA Increase Overview.

Health and Dependent Care FSA Carryover. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing separately. That means for a married couple each parent can contribute 2500 to their own Dependent Care FSA for a total of 5000.

Health and dependent care FSA plans can now carryover ALL remaining balances from 2020 to 2021 and then again from 2021 to 2022. Typically the maximum age for a child to qualify for dependent care through an FSA is 13. Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits.

The Consolidated Appropriations Act CAA 2021 temporarily allows for an eligible employee to be reimbursed expenses for dependents through age 13 ie dependents who have not yet turned 14 for the 2020 plan year. Limited Purpose Flexible Spending Account. Complement your HSA and save more on dental and vision.

Before school or after school care other than tuition Qualifying custodial care for dependent adults.

Increase In Dependent Care Fsa Under The American Rescue Plan Act Tri Ad

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

2441 Child And Dependent Care Credit W2

Dependent Care Fsa Eligible Expenses Qualified Child Care Items

Expanded Flexibility For Health And Dependent Care Fsas And Health Plan Elections Advisories Aflac

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Explore Our Sample Of Child Care Expense Receipt Template Receipt Template Child Care Services Receipt

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

You Can Depend On Dependent Care Onedigital

The Child And Dependent Care Credit Expansion 2021 Updates Goodrx

Dependent Care Fsa Eligible Expenses Qualified Child Care Items

Flexible Spending Arrangements Fsa And Dependent Care Assistance Program Dcap Washington State Health Care Authority